In 2019, do your VAT tax return without a problem, using this example in Microsoft Dynamics 365.

Starting 1 January 2019, the low VAT rate goes up from 6% to 9%. This increase of the low VAT rate makes certain goods and services more expensive for retail customers, and demands changes to the accounting system. This is why it was important for organizations to already start preparing for this in 2018, because the impact on the administration, the prices of goods and services, the invoicing and the VAT return will be big at the turn of the year.

What to do?

- Modify the accounting programs so that your administration is using the correct VAT rate as of 1 January 2019. Note that you might still need to use the old VAT rate of 6% in the first few months of 2019. Don’t close this out in the system yet.

- Make sure that the new VAT rate appears on the invoice for products and services provided after 1 January 2019. If the service or the product was delivered in 2018, but the invoice has a date in 2019, you can still use the old rate of 6%.

- For quotes you are drafting in 2018, be thinking ahead about the goods and services that will actually be delivered in 2019. For those, you will have to budget the VAT rate of 9%.

- Products purchased at the old VAT rate of 6% and which are returned after 31 December 2018 must be credited under application of the 6% rate.

- Update your register system with 9% as the low VAT rate.

Example VAT setup in Microsoft Dynamics 365 for Finance and Operations

Corrections over 2018 relating to the reduced VAT rate can still be made using the 6% rate after you do the following:

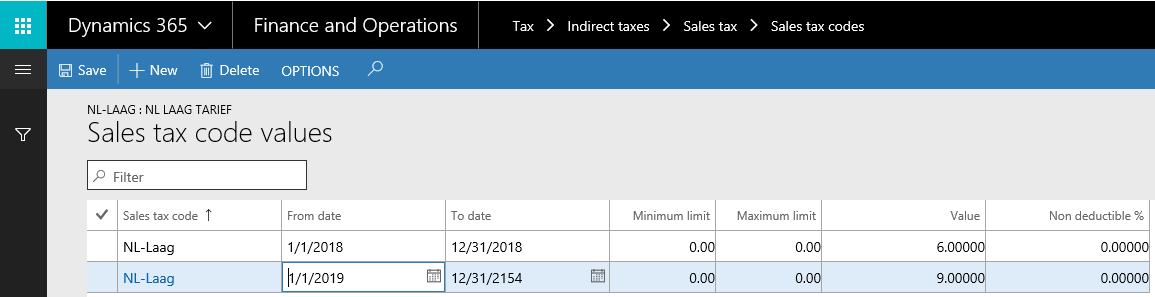

1. Adjust the End Date of the current Sales tax code of 6% to 31-12-2018.

2. Add a Sales tax code date range for the 9% rate. Enter a Start Date of 1-1-2019 and set the latest possible end date. The last possible date you can set in D365FO is 31-12-2054.

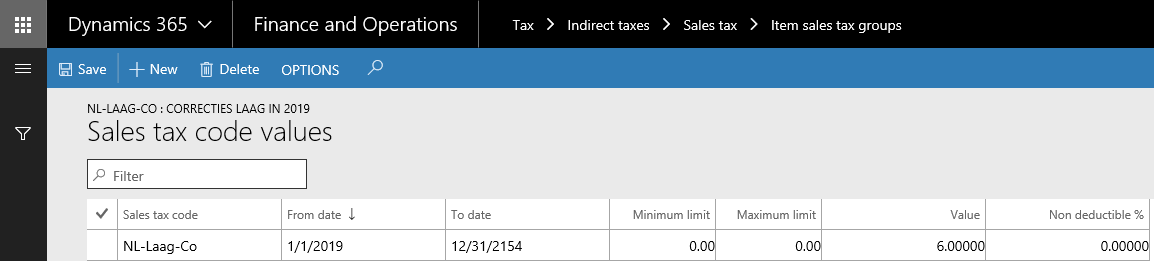

3. Create a new Sales tax code. For example, “NL-Low-Corr” for correction with a booking date in 2019 but for entries in 2018. For this Sales tax code, the start date will also be 1-1-2019 and the end date will be the last possible date. Set this percentage at 6%.

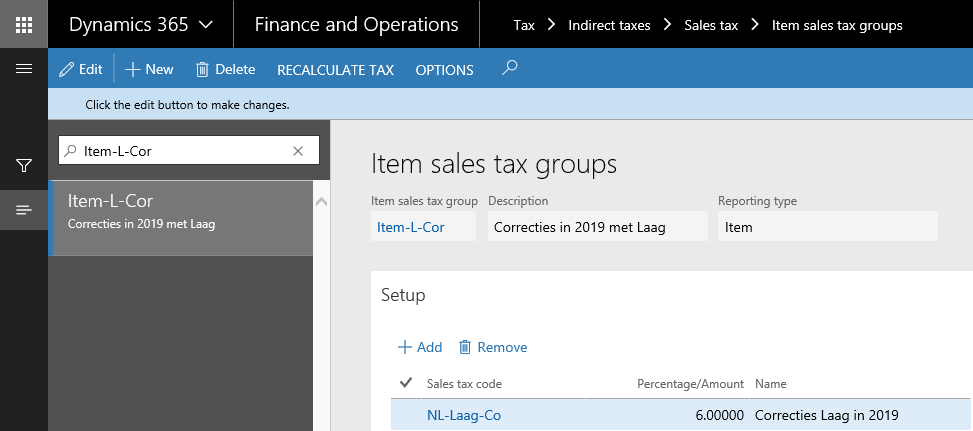

4. Alongside the new Sales tax code, you also create a new Item sales tax group. This allows you to select this in the correction entry. This group is only linked to the tax code created in step 3.

Tip!

Even if customers will be receiving services or products in 2019, it’s a good idea to invoice them in 2018 if possible. Even if the service is only going to be rendered in the middle of 2019 (for example), if the customer pays the invoice in 2018 the customer pays 3% less in VAT, and you collect on your invoice earlier.

The upcoming increase in the VAT rate doesn’t have to be a problem – if you’re prepared. Set up your system ahead of time and you won’t have any headaches with your VAT returns in the new year.